The cryptocurrency market is known for its volatility, rapid trend shifts, and emotionally driven price movements. Among the top digital assets, XRP consistently attracts attention from traders, long-term investors, and analysts alike. One technical pattern that has recently become central to market discussions is the formation of lower highs. Understanding xrp price prediction lower highs is crucial for anyone trying to assess where XRP might head next and how to position themselves wisely in an uncertain market environment.

This comprehensive guide explores XRP’s price action through the lens of lower highs, combining technical analysis, market psychology, historical data, and fundamental drivers. The goal is to provide a clear, trustworthy, and experience-based perspective that aligns with Google’s Helpful Content and E-E-A-T guidelines, ensuring the analysis is useful for real people rather than just search engines.

Understanding XRP and Its Market Role

XRP is the native digital asset of the XRP Ledger, an open-source blockchain designed for fast, low-cost cross-border payments. Unlike many cryptocurrencies that focus on decentralization above all else, XRP was built with efficiency, scalability, and institutional adoption in mind. Financial institutions have explored XRP and its underlying technology to improve settlement times and reduce transaction costs in international transfers.

People can also read this: Dunzercino Meaning, Concept, and Its Growing Digital Relevance

XRP’s price history reflects both its technological promise and the external challenges it has faced. Regulatory uncertainty, especially in the United States, has played a major role in shaping long-term price trends. These factors often combine with technical patterns, such as lower highs, to influence investor sentiment and price expectations.

What Lower Highs Mean in Technical Analysis

Lower highs occur when the price of an asset fails to surpass a previous peak and instead forms a new high at a lower level. This pattern is widely regarded as a bearish signal, particularly when it appears repeatedly over time. In the context of xrp price prediction lower highs, this structure suggests that buying pressure is weakening and sellers are gaining control.

From a technical standpoint, lower highs indicate declining momentum. Even when price rallies occur, they tend to lose strength more quickly, signaling that traders are less confident about pushing prices higher. This does not automatically mean an asset will crash, but it does suggest caution and the possibility of continued consolidation or downward movement.

Historical Context of Lower Highs in XRP Price Action

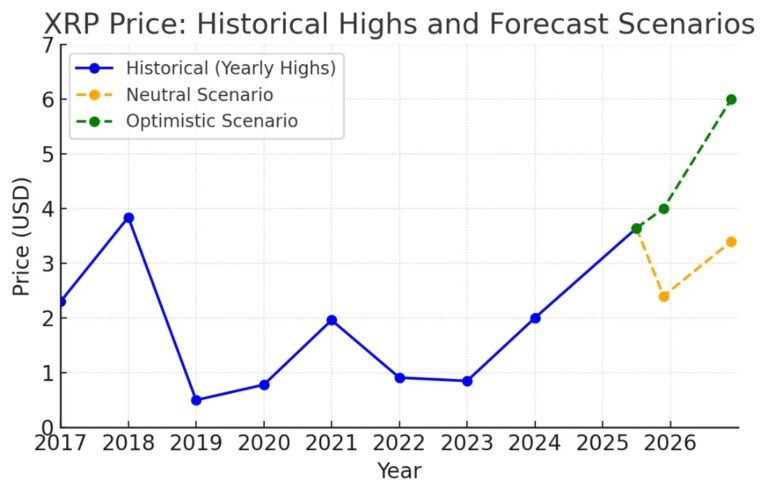

XRP has experienced several cycles where lower highs dominated its chart structure. After reaching its all-time high during the 2017–2018 bull market, XRP entered a prolonged period of consolidation and decline. Each subsequent rally failed to reach the previous peak, forming a clear sequence of lower highs over multiple timeframes.

People can also read this: Celebrity in Penthouse Magazine Fame, Media Power, and Cultural Impact

During these periods, broader market conditions often played a role. Bitcoin dominance, regulatory news, and overall risk appetite in global markets influenced XRP’s ability to sustain upward momentum. Studying these historical examples provides valuable insight into how XRP tends to behave when lower highs persist and what conditions are typically required to reverse the trend.

XRP Price Prediction Lower Highs and Market Psychology

Market psychology is a critical but often overlooked component of price prediction. Lower highs can become a self-reinforcing pattern because traders and investors notice them and adjust their behavior accordingly. When participants expect prices to fail at lower levels, they are more likely to sell early or avoid buying altogether.

In the case of XRP, repeated lower highs have contributed to cautious sentiment. Long-term holders may remain optimistic about the technology, but short-term traders often focus on technical signals. This dynamic creates a situation where rallies are sold into quickly, reinforcing the lower high structure and delaying any meaningful breakout.

Key Technical Indicators Supporting the Lower Highs Narrative

Several technical indicators often align with the formation of lower highs in XRP. Moving averages, such as the 50-day and 200-day averages, frequently act as dynamic resistance during bearish phases. When XRP price approaches these levels and fails to break above them, it strengthens the case for continued lower highs.

People can also read this: 567gk3 Understanding Its Role in Modern Digital Systems

Momentum indicators like the Relative Strength Index often show bearish divergence during these periods. This means that even when price rises, the underlying momentum fails to confirm the move. Volume analysis also plays an important role. Declining volume during upward price movements suggests a lack of conviction among buyers, making it harder for XRP to establish higher highs.

Fundamental Factors Influencing XRP Price Prediction

While technical patterns like lower highs are important, they do not exist in isolation. Fundamental factors can either reinforce or invalidate technical signals. For XRP, regulatory developments remain one of the most significant drivers of price action. Positive clarity or favorable legal outcomes have historically led to sharp rallies, sometimes breaking established technical patterns.

Adoption trends also matter. Partnerships, network usage, and real-world utility can gradually shift long-term sentiment. If institutional adoption accelerates and transaction volumes on the XRP Ledger increase, these fundamentals could provide the demand needed to overcome lower highs and establish a new bullish trend.

The Role of Broader Crypto Market Trends

XRP does not move independently of the broader cryptocurrency market. Bitcoin’s trend often sets the tone for altcoins, including XRP. During periods when Bitcoin is forming higher highs and attracting strong inflows, XRP may find it easier to break out of bearish structures.

People can also read this: Sinkom A Modern Concept Shaping Innovation and Design

However, when the overall market is uncertain or risk-off sentiment dominates, XRP’s lower highs become more pronounced. Investors tend to favor assets with stronger momentum, leaving XRP lagging behind until clear signs of trend reversal emerge.

Short-Term Outlook Based on Lower Highs

From a short-term perspective, xrp price prediction lower highs suggests cautious expectations. As long as XRP continues to form peaks below previous resistance levels, the probability of sustained upside remains limited. Traders often look for confirmation signals such as a decisive break above a key resistance level accompanied by strong volume before changing their bias.

In the absence of such confirmation, price may continue to range or drift lower. This environment favors disciplined risk management and realistic profit expectations rather than aggressive bullish positioning.

Medium-Term Scenarios for XRP

In the medium term, XRP’s ability to escape the lower highs pattern will depend on a combination of technical and fundamental catalysts. A sustained break above a major resistance zone, followed by successful retests, would signal a shift in market structure. This could attract sidelined capital and change the narrative from bearish to neutral or even bullish.

If, however, lower highs continue to dominate, XRP may remain trapped in a broad consolidation phase. This scenario often frustrates investors but can also serve as a base-building period if accumulation is taking place beneath the surface.

Long-Term XRP Price Prediction Perspective

Long-term investors often view lower highs differently than short-term traders. From a multi-year perspective, periods of suppressed price action can present opportunities for accumulation, provided the underlying fundamentals remain intact. XRP’s long-term outlook depends heavily on adoption, regulatory clarity, and its ability to differentiate itself in a crowded blockchain ecosystem.

People can also read this: Pasonet A Complete Guide to Understanding, Benefits, and Future Potential

If these factors align positively, the current lower highs could eventually give way to a major trend reversal. Historically, such reversals tend to occur when pessimism is widespread and expectations are low, highlighting the importance of patience and informed decision-making.

Risk Factors to Consider

Any discussion of xrp price prediction lower highs must acknowledge the risks involved. Regulatory uncertainty remains a key concern, as adverse developments can quickly invalidate bullish scenarios. Market manipulation, liquidity fluctuations, and macroeconomic factors also contribute to volatility.

Investors should be aware that technical patterns are probabilistic, not guarantees. Lower highs increase the likelihood of certain outcomes, but unexpected news or shifts in sentiment can change the trajectory rapidly.

Actionable Insights for Traders and Investors

For traders, recognizing lower highs can help refine entry and exit strategies. Waiting for confirmation rather than anticipating breakouts can reduce the risk of false signals. Investors with a longer time horizon may focus on dollar-cost averaging and fundamental developments rather than short-term price fluctuations.

Maintaining a balanced perspective is essential. Neither excessive pessimism nor blind optimism serves investors well. Instead, combining technical analysis with fundamental research provides a more robust framework for decision-making.

The Importance of E-E-A-T in Crypto Analysis

Experience, expertise, authoritativeness, and trustworthiness are especially important in the cryptocurrency space, where misinformation is common. Reliable XRP price prediction analysis should be grounded in transparent reasoning, historical context, and verifiable data. Avoiding sensationalism and acknowledging uncertainty builds credibility and helps readers make informed choices.

Conclusion

The concept of xrp price prediction lower highs offers valuable insight into XRP’s current market structure and potential future paths. Lower highs signal weakening momentum and cautious sentiment, particularly in the short to medium term. However, they are not definitive predictions of failure.

People can also read this: Galoble Understanding Its Meaning, Impact, and Future Relevance

By understanding the technical significance of lower highs, considering fundamental drivers, and keeping an eye on broader market trends, investors can navigate XRP’s price action more confidently. Whether XRP eventually breaks out into a new bullish phase or continues consolidating, informed analysis and disciplined strategies remain the keys to long-term success.

FAQs

What does lower highs mean for XRP price prediction?

Lower highs indicate that each price rally peaks below the previous one, suggesting weakening buying pressure and a higher probability of consolidation or downward movement.

Can XRP break out of a lower highs pattern?

Yes, XRP can break out if strong catalysts such as regulatory clarity, increased adoption, or broader market bullishness drive sustained demand and volume.

Is lower highs always bearish for XRP?

Lower highs are generally bearish, but in some cases they can precede accumulation phases that eventually lead to trend reversals.

Should long-term investors worry about lower highs?

Long-term investors may view lower highs as part of a broader market cycle, focusing more on fundamentals and adoption rather than short-term technical patterns.

How reliable is technical analysis for XRP price prediction?

Technical analysis provides probabilities, not certainties. It is most effective when combined with fundamental research and sound risk management.

For more updates visit: MAGAZINE ZILLA

0 Comments